Hello. While we are on the subject of money and budgeting, I'll continue along these lines. A question from one of our readers on yesterdays post.......

Sorry if this question is being nosey but I will be going into retirement with just the basic state pension and I was wondering how you have managed to build up savings to replace large items such as your car. I would like to have some savings as back up in case anything major needs replacing.

Hi, not nosey at all, it's a question everyone will be asking at some point in their lives. What happens when the wages stop and the pension starts? How will I manage? What I can't do is to advise on pensions. I happen to have a small private pension because the company I worked for at the time, around the mid 1980's, advised us all to pay into the company pension. I did so along with everyone else. I worked there for five years, and promptly forgot about it after I left, until about twenty odd years later. Luckily It was a large national transport company which was still in business, albeit under a different name. I must say, it was a nice surprise to find that out.

It's inevitable that a persons income will be reduced on retirement, except for the very rich of course, but I am talking about ordinary working folk here. I don't know how far off your retirement is, but something you can do is to find out exactly how much pension you are likely to receive, and use that figure as a base line, and start living on that amount before you retire. Anything left over can be put away into a separate account to start your emergency fund. This will give you a head start and be a good challenge to prepare yourself for any changes you need to make.

It would be a good idea to go through all your wants and needs, and to weed out anything that is in the wrong category. As I said before, wants and needs are subjective and exclusive to you. It stands to reason that you might have to modify your needs and shift some of them over to wants, because you will not be getting as much money coming into your bank account.

Some of the things you have been used to buying might have to be dropped. Your lifestyle expectations, may have to be modified, you might have to lower your sights. Getting into a routine where you unconsciously open your purse, or click on an item that you want to buy from a web site, will be a hard habit to break. What you can do is delay buying something that you want, for 24 hours, then think again, and ask yourself do I really need it.

I have collected a lot of stuff throughout my life, and I now find I don't need any more. What I already have will hopefully last me. There may be an instant where something packs up and will need replacing, but if it only looks a bit dated and it aint broke, I don't need a new one.

Anyone who is coming up to retirement age needs to take stock of their lives. There will have to be some tightening of the belt, some deliberation on what they can do without. It's a bit like de cluttering, sorting out a cupboard or drawer.

My goodness it sounds like a lot of doom and gloom, doesn't it. Can't afford this, can't afford that, have to stop going to dancing or gym, have to give up the weekly meal out, no more shopping trips to town. If you are in the mindset that you get pleasure out of spending money, you will struggle. You will be miserable, you will sit at home and feel sorry for yourself, skint, no money to spend.

When you retire you will have less money, but you will be gaining a lot more time. Time is more precious, more valuable than money. Time lost will never be replaced. Look at this new chapter in your life as the time you start living, and a good life is not about how much money you have. You will have to modify your lifestyle choices, but you will have more time to enjoy life.

Ooops, going away from the question here. How have I managed to build up savings to replace large items like a car? I keep a car for about 3 - 4 years. I will need to have around £6,000 saved to buy the car I want. Over 3 - 4 years, that's doable.

My thrifty and frugal living ensures that money builds up in the bank, because I don't spend it. Simple as that, I DON'T SPEND IT. I work out what I absolutely must pay for, then I work out if I can afford some treats, and what is left only gets spent when something needs replacing. I don't call it savings, it's an emergency fund. I don't have any long term savings. A year ago I needed a fridge freezer, I had the cash to pay for it. Coming up I have my car road tax and insurance to pay, the money is there waiting.

Someone asked a question once on MSE, what do you do with any spare money? The answer is, no money is spare, it is all earmarked for something.

I am disciplined enough to NOT SPEND any money left over. Another way of doing it would be to put aside money for emergencies as soon as it has been paid into your account. Squirrel it away somewhere, it is not for spending, save it for emergencies.

I hope that has given you food for thought. Thanks for asking. Don't worry, you will manage.

Thanks for popping in. We'll catch up soon.

Toodle pip

Showing posts with label Money. Show all posts

Showing posts with label Money. Show all posts

Wednesday, January 4, 2017

Tuesday, January 3, 2017

Life is good on a pension

Hello. Something someone said about not knowing all of my story which got me thinking. There must be newer readers who haven't read from the beginning, so will not know the background to my frugal journey. I've had a look through my bank statements and found some scribbled notes which will shed a bit of light about how skint I actually was. I can't put actual dates to some of the reasons why my income dropped very low, but it was round about my early to mid fifties when I started reducing my driving hours which reduced my paid income. I was not enjoying the job so I chose to work less hours.

Before that I was also running a small businesses, I bought in stock and sold at shows and events. It was a lot of work, making a little bit of money, but it didn't last very long. The recession kicked in and people stopped buying non essential items. I had to close it after three years, because I was starting to lose money.

After that, I started another business, an Introduction Agency/Singles Club. That was also a lot of work while still driving part time. Over three years it just about covered the expenses so I closed it, having made nothing.

A while later I took a short break from driving and bought a new catering trailer, got a pitch for it and started work on an industrial estate. I didn't last long. It was the wrong time to start, middle of winter, business was slow, and I hated the smell of the cooking. I sold the trailer and lost £1000 on it. My bank balance took a hit and was very low, so I had to go back to driving to earn some money.

When I was 59 I had an operation and took 12 weeks off to recover. I wanted to go back to work, but they announced they were closing the depot so I didn't have a job to go back to. I was a job seeker for the last seven months until I could fully retire at 60.

I have always meticulously checked my bank statements, keeping a beady eye on that bottom line. Sometimes it plunged perilously low so I had to do some calculations to make sure there was going to be enough to cover the standing orders, and pay the mortgage. If it dropped too low, there was only one thing to do, earn more money.

Here are some of my scribbles. Note to myself DON'T SPEND.

Only £547 left in the bank on this statement. I think that was two mortgage payments. There was a lot of juggling going on.Here the balance didn't look too bad, but when I calculated everything that was going to come out during the month, it dropped dramatically.

This is low but not too bad. Got to get that money in money out balance a bit better though.

Going down again. all my business transactions were going through my current account. I cancelled the business bank account when they started making charges. My accountant advised it was ok to do this as long as the paperwork was all in order.Oh my gawd, I think that was the lowest.

I was sailing a bit close to the wind at times, but strangely enough I wasn't too bothered. I never dropped below the bottom line, even though it was a challenge to stay afloat. My first state pension payment of £136 was paid on May 18th, I had a balance of £1,400. I felt safe then knowing that this amount would be arriving every week and would never stop. I was also receiving a small amount from a private pension which was £33 every four weeks. Both of these have increased over the years, and are my only income.

So there you are then. I've been down in the basement, now I'm on the way back up again. My mortgage is paid off and I have an emergency fund, so life is good on a pension.

Thanks for popping in. We'll catch up soon.

Toodle pip

Tuesday, October 18, 2016

Do not despair, make it a challenge.

Hello. We wake up this morning to more doom and gloom in the press, inflation is rising and we are all going to have to pay more for the things we need to give us the life that we aspire to. But wait a minute, not everyone will suffer, those of us who understand the difference between a need and a want, will still be able to adjust our finances to get the best possible deals. We know it's all down to juggling, and from the comments I get from my readers, most of us have got it about right, so this post is not aimed at you.

What do you do when you can't afford to buy new clothes from a High Street shop? Answer, you go to a charity shop, a car boot sale, a rummage sale, a garage sale, accept hand me downs, swap clothes with friends, look on ebay and the free sites.

What do you do when you can't afford expensive brand name foods? Answer, you try the shop's own brand, you buy the Value and Basics labels, you shop around in different places, you get to know the prices of everything you buy on a regular basis, you look for reductions, offers, and out of date reductions.

What do you do when you can't afford your utilities? Answer, you check how many kw's you are using per annum and go on the comparison sites and look for a better deal. You contact your present provider and ask them for a cheaper tariff. You use less gas, electricity, and water by not switching things on until it is absolutely necessary. Flick a switch, turn a tap on, it will cost you.

Petrol is going up, how can you spend less? By driving correctly, not rushing about, no harsh braking or fast acceleration. Plan your driving by what you can see ahead of you. There's been many times when I have seen a bend or a junction up ahead and have slowed down by just taking my foot off the gas, when the car in front has approached it at speed, then slammed their brakes on. Remove all the clutter from your car, more weight uses more petrol.

Shop around for literally everything. Think about what you need, then look in different places to get the best price. Give yourself time before you sign a cheque, open your purse, or put your card in a machine. Be very aware of what you are spending your money on. Absolutely no impulse spending, go home and think about it.

Put a little money aside every week or month, into a savings account. Doesn't have to be much. One day you will need a new washer or fridge. Your car will eventually conk out, if you have planned and saved it won't be so painful when you come to change it. I've had my car almost two years, I started saving as soon as I got it, there will be enough in the pot when I come to change it.

If you enjoy a few extras at Christmas, start saving on January the 1st. If you like a summer holiday, have a pot for that. Write a plan on a piece of paper, you don't need fancy electronic gadgets to keep track of your money, a notebook does the same job. The miles I do for my walking challenge are recorded on a calendar, I don't need a gadget for that. Pen and paper is all you need. Keep a spending diary, record every penny you spend, look back on it often.

All this is common sense, and a lot of you who are a similar age to myself will know what I am talking about. It's the younger people who are struggling, those that don't get the benefit of savvy parents to teach them, which I feel for.

Right, so what do you do when you are really struggling to make ends meet? All of the above, but what you don't do is BORROW. Loan companies know people will be struggling once inflation rises and gets a grip, they will be increasing their advertising to reel in all those who don't know which way to turn next. The sharks are waiting for the kill.

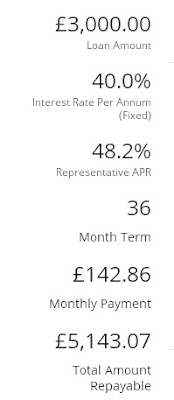

Do not fall for it. MSE is full of posts from people who are in such a mess with their finances. They know they have been living beyond their means, and know they will never have a life if they don't try and do something about it. Borrowing is too easy. Spending someone else's money is too easy. If people can't afford to pay for something, how are they going to afford the repayments? Look at the figures below, found on a random web site. Borrow £3,000 to buy a car. It takes three years to pay it back. You will have paid £5,143 to this company if you borrow from them, and you will be left with a scrap heap of a car worth nothing.

What did I do when I started driving? I bought a battered old Bedford van for cash saved. Changed it for another slightly better van, then worked my way up with more old vehicles. I went to car maintenance classes at the college to learn how to do the basics. And at long last after years of driving around in a vehicle which I could never be sure of it getting me there, I now have a decent car.

So, don't despair if the cost of living is going up, try and keep one step ahead. Appreciate what you already have. Find ways of staying in control, make it a challenge, don't let the buggers beat you. There is Life after Money.

Thanks for popping in, we'll catch up soon.

Toodle pip

Monday, May 2, 2016

Ten good reasons why I don't have contents insurance.

Hello. While pondering over a few topics for blog posts, I came up with the idea of delving a little deeper into the whys and wherefores of how I organize my life. My quirky ways of doing things or not doing things, and the reasons behind my way of thinking might not suit everybody. I tend not to go with the flow, I like to explore and find out what works for me, even if it goes against the grain and people might question my sanity. I might make a one sentence statement which does not give the whole picture, so I am going to do a series of posts called Ten Good Reasons Why.........and fill in the gaps.

So the first statement is

Ten good reasons why I don't have house contents insurance.

1. There is very little stuff of value in my house. I could happily give it all away and start again. Most of it was acquired cheaply second hand or given to me free. The things I have bought from a shop are old and not worth very much.

2. I have no jewelry, no collectors items worth a lot of money. My electrical gadgets are ancient.

3. I have enough money in my emergency fund to replace anything broken, damaged, or stolen.

4. I have no feelings for my stuff, I am not married to my stuff, I am not in love with it. It is just stuff. It doesn't belong to me, I am borrowing it while I am alive, I can't take it with me.

5. I don't need a lot of stuff. I can manage with the basics. A bed, a chair, something to cook my food on, clothes to wear, bedding to keep warm.

6. If I had to start again I would be happy to purchase second hand, ask for items I find in a skip, buy at a car boot sale or charity shop, accept donations from friends.

7. I don't want to pay for contents insurance. The money I have saved over the years by not paying, more than covers the cost if I had to buy something.

8. Insurance is all about risk, do I want to take the risk by not having it, or do I want parts of my life to be cushioned against risks, and pay for the cost of it. Peace of mind doesn't come cheap. I am happy to take the risk and not pay for contents insurance.

9. I am not a worrier, I will not lose sleep thinking about what if all my stuff is lost.. I take each day as it comes, living for the now, and not worrying about how long my stuff will last, or if it will be stolen, or lost in a fire or broken in an accident. What will be will be. I prefer to live with the thought that it might never happen, rather than, oh dear, what if.

10. Looking for the right policy can be very time consuming, playing one company off against another, trying to get the best deal. Small print baffles me, big numbers baffle me, the wording of policies baffles me. I don't want to be bothered with it.

Everyone must assess their own needs for insurance, dependent on how much they value their possessions, the value of their possessions, and what it would cost to replace them. Personality comes into play as well, whether they are risk takers or risk averse. Whether losing their possessions would have a detrimental affect on their quality of life, or whether they are confident to move on and start again.

No painting today, it's been raining. The Walking Group mileages are rolling in, the page is slowly filling up, and it's looking good. It's great that you are making a real effort. Thanks for popping in. We'll catch up later.

Toodle pip.

Friday, April 22, 2016

Keeping track of where the money goes

Hello and good morning. It's Friday, and as Ready Steady Go used to say at the beginning of their Friday night music programme, the weekend starts here. Thank you all so much for your comments on the previous post, your words made very useful and enlightening contributions. It's great to get the views of others, adds meat to the bare bones if you like. It's a subject that needs to be aired on occasions, to highlight the good work of Women's Refuge, and to show that if anyone is suffering in silence there are places to get help.

So, what's on the agenda today? My winter fuel bills, as expected were quite high, so this has prompted me to sort out my utility bill files, put them in order, and work out the figures for the past year.

Most people prefer to pay monthly by direct debit which comes straight out of their bank account. I am a bit old fashioned, I like to use the utilities first, gas, electric, and water, then pay for them on a quarterly or half yearly bill. The direct debit system works ok for those who have multiple financial commitments and find it difficult to keep track. Not a good idea to miss paying essential bills, they need to be paid. My financial commitments are simple and I find it easy to budget on a monthly and yearly basis.So what's the situation at Tightwad Towers. I have some figures in front of me.

Four gas bills from April 15 to April 16

£5.30 April to July. Cooking and baths.

£5.84 July to Sept. Cooking and baths.

£32.64 Sept to Dec. Also, bit chilly, some heating.

£98.13 Dec to April. Also, cold bit more heating.

Total £141.91 for the year. Average £11.82 per month.

Four electricity bills from April 15 to April 16.

£26.55 April to July. Longer days, spend time outside.

£38.41 July to Sept Don't go out much in school holidays.

£23.40 Sept to Nov Cutting down in readiness for winter.

£71.99 Nov to April Lights on, staying in. Computer on.

Total £160.35. Average £13.36 per month.

I have two water bills a year from two companies. Water into the house and waste water out from Anglian. I am on a meter. Surface water removal by Severn Trent.

Anglian

£35.67 Dec 14 to June 15

£32.55 June 15 to Dec 15

Total £68.22.

Severn Trent

£28.49 Oct 15

£28.49 April 16

Total £56.98

Total water charges for the year. £125.20. Average £10.43 per month.

The other regular bill coming in is taken by direct debit, my broadband and land line is paid monthly. When I changed supplier this was the only option offered. I get an email every month from EE, which I don't bother reading because I know more or less what is in it. I can confirm the amounts when I get my bank statement. It is usually around £35 a month. I could probably get it cheaper if I shopped around, but I don't want to be tied into any contracts, and then after the one or two year period have to look for another deal. I count my computer as my hobby and entertainment. I don't go out hardly at all in the evenings, don't pay a TV licence, don't go to the pub, don't eat out. My unlimited broadband is as important to me as my gas and electric.

I won't go into detail on my other expenses, I have house insurance but not contents insurance. I have all the costs involved in running a nice car, road tax, insurance, MOT, recovery, and depreciation. For any new people who have started reading, I don't have a mortgage or pay rent.

So there you are. Financial review all done and dusted. Have you looked at your bills lately? Do you keep them in a file? Or are they all computerized? Maybe you do a spread sheet on the computer, I don't. Maybe you do internet banking, I don't. Do what's best for you.

Thanks for popping in. We'll catch up soon.

Toodle pip

Saturday, February 27, 2016

Can we tempt you with more dosh?

Hello and Good Morning. It's Saturday and Sounds of the Sixties is just finishing, so I'll turn the radio off because it's a distraction. No point in leaving it on if I am not listening to it.

This post has connections with the 'No Quick Fix' theme of yesterday. All will become clear if you read on. Below I have copied a letter I received from my bank, dated 6th June 2008, yes I keep all my banking correspondence filed away for future reference. If you want to read it you might have to magnify it, but the gist of it is that they are offering me a Personal Reserve fund, an amount of money that I can use if I have exhausted my balance and my overdraft. I have never had an overdraft, by the way. When there is no money left, this Reserve Fund kicks in. Well isn't that nice of them!

The letter states that the Personal Reserve is help when I need it most, so nothing to worry about then. When I am absolutely skint there will be money in the pot to enable me to carry on spending. Such a comfort to know this. But hang on a minute, there has to be a catch, there usually is. If I go into the reserve I have to pay a fee of £22 for the first five consecutive working days, and if I am still using the reserve there will be a further fee to pay of £22 for each subsequent five working day period, regardless of the number of transactions in that period. Now for someone who sees the word 'interest' as a dirty word, that arrangement sounds horrific.

This letter arrived at about the same time as I was reducing my working hours which reduced my pay. My bank balance was slowly shrinking, almost to the point of dropping below the bottom line. It never did though, I always pulled myself back up again.

Of course there are a couple of other niggly charges that they can add on as well. Returned transaction fee £8 per transaction, and Guaranteed transaction fee, £8 per transaction. So if you take your eye off the ball and slip up it will cost more, which is what happens normally if you overspend or make a mistake with transaction dates.Did I sign up for this fantastic offer? What do you think? Nope, I wrote and declined it. If you have been reading my blog long enough you will know that I don't spend more than what I have coming in. Below is a little snippet from the top of my monthly statement. Emergency Borrowing NIL. You can see that they have thrown a tempting morsel my way of a personal loan of £20,300. They don't give up do they.

Right, what you see here is how much credit I can have with my one credit card. I could have a nice treat with that, but, and here's the catch, the same rules apply to the reserve fund and the overdraft, IT ISN'T MY MONEY. A lot of people would look at that and think, let's spend it, I deserve a holiday. Not a good idea, because it has to be paid back with that dirty word, interest.

Every time I use my credit card, I have the funds in my bank account to pay it off. I use it for convenience, and for the consumer protection it gives me on larger purchases that might go wrong, and it gives me points. I put part of my car payment on this to help rack up the points. All of my small purchases I pay for with cash. It's very rare I use a card in the discount stores.

Now I need to make the connection with what I have written here, to 'No Quick Fix' There are thousands of people with lots of small debts spread around lots of companies. Lots of bits of paper coming through the post, asking for payment. Lots of bits of paper getting lost, shoved in a drawer, and ignored. It's called burying the head in the sand, I'll sort it one day. Keeping track can make it very difficult to balance money coming in with money coming out.

Wouldn't it be much easier to have one payment going out to cover all the bills? Debt consolidation sounds like a good idea, get a loan and repay all the debts with it, then there is only the loan to pay off every month. Simple. Sounds like a good quick fix to me, or does it?

A loan does not get rid of the debts, it just moves them to a different place. Get the loan, pay off the cards, and bingo. The cards are cleared, the catalogues are cleared, the payday loans are cleared, the overdraft is cleared, giving you a fresh new start. But it isn't. What happens if an unexpected expense occurs, something breaks and has to be replaced, or the holiday of a lifetime opportunity is too good to turn down, or a wedding is planned, or even a night out on the town with your mates is on for next week? That's OK, you still have the cards to pay for it. And so the downward spiral starts again.

Moving debts onto a consolidation loan is a quick fix which is not going to work, if you haven't learnt any lessons. If your attitude to spending has not changed, you will find yourself back at square one, with even more debt. It is all over Money Saving Expert Forum that it is not a good idea to move debt around, with the one exception of moving some of it to a 0% interest card, and even then, that 0% is only going to last for a year or so. If you have not paid off that card before the time runs out you will find yourself with even more of that dirty word, interest, to pay.

Forget quick fixes for sorting out debt, the remedy needs to be long term. There is a Statement of Affairs calculator on MSE where you list all your incomings and outgoings. Fill that out to get a better picture of where you're at.

It's not rocket science, changing your mindset about how you spend over the long term is the key. You don't lose weight by a frenzied stopping eating over a couple of months because it will pile back on again, and you don't get out of debt by juggling it around and shifting it to different places, it's still there.

Grey skies today, I won't be going far.

Thank you for popping in. I hope you have a good weekend. Catch up soon.

Toodle pip

Saturday, February 6, 2016

I do my own thing.

Hello. I've been reading a lot just lately on the different methods people use to save money, on web sites, newspaper articles, forums, and blogs. It strikes me that there are a myriad of different ways to approach this living frugally lark, and no one has all the answers, me included. As a single person pensioner with a small income and no savings my ways are going to be different to those who are younger with a family. There isn't a one size fits all.

I know quite a few people who have no need to watch the pennies. Although no one likes to talk about their financial status it is obvious that they have managed to plan for the future and live in houses a lot nicer, bigger, and newer, than mine. I am assuming that as they drive around in brand new Chelsea Tractors, they must have been in good jobs to be able to splash the cash. I bet you are thinking that there is a touch of jealousy creeping in here, you'd be wrong. Anyone who has the cash to buy what they want can do so. It's when people spend money they haven't got and go into debt for it when the trouble starts. It's a downward spiral from there.

Money saving among the well off is different to the way I do it. I see wealth as a ball and chain around my neck. Ok, imagine you have accumulated £50,000 throughout your working life. What do you do with it? If you have won it or been given it, you wouldn't look on it in the same way as if you had earned it by sweating your nuts off in a job that bored the pants off you. There are thousands of crooks out there who are waiting to get their grubby hands on your nest egg, and I don't just mean scamming individuals as if that isn't bad enough, I mean the legitimate financial institutions who aim to confuse the hell out of you with their predictions, offers, accounts, investments, and personal finance advice. They tell you to put it in this account, invest in that company, buy an ISA or bonds, shift it around several bank accounts. What a load of faff just to hold onto your cash. Phew, I couldn't get my head round that, maths was never my strong point, in fact I am chuffin useless at it. I'm glad I don't have to worry about all that, my personal finances are a lot easier to work out. Juggling money about is one kind of money saving I don't have to bother with.

Extreme couponing has been in the news again. I was asked the question by a journalist, 'Do I collect coupons? My reply, no. Those who have a family to look after and buy a far wider range of products than I do, might save a few bob, but you have to remember, the only reason that companies give out coupons, is to make you buy more. The pictures you see of coupon shoppers pushing trolley loads of stuff back to their cars, then stockpiling it in their garage, makes me wonder if it is more of an obsession rather than an effort to save money. What I want to know is once they have accumulated all this stuff, at what point do they then stop spending altogether, and use up what they have? How do they decide when they have enough? The amount of time and effort they put into searching for the coupons would possibly make it pay less than the minimum wage. Another kind of money saving I don't want to bother with.

Cash back sites seem quite popular, whenever you want to buy something if you go through one of these sites eg, Quidco, they give you money back when you make purchases through their web site. I don't want to sign up to any more sites, and I don't want to do internet shopping because I don't trust the security of it. And what about that Groupon thing, is it still going? Sign up and get all these special offers. If I wanted something I would go out and look for it, I don't need another marketing ploy to get me to part with my cash.

Comparison sites, well they confuse the hell out of me. I want an easy life, if I am happy with what I am paying for goods and services I leave well alone. If I want to change and look for a cheaper deal I will first read Money Saving Expert, then go to the web sites of possible companies, and choose one for myself. Don't tell me to go to a comparison site, I can't be bothered.

So, I have my own methods of managing my money, and although some may say I go to extreme lengths to save a few pennies here and there, I have proved that over a period of time, those pennies mount up and make £'s. My simple way of thinking means that I buy what I need, and if there is anything left over, I can then move on to spend what's left on what I want. I will continue to search out cheap shops to buy food. I will not switch the heating on until I am cold, it's lucky that I spent years working outdoors which got me acclimatized to lower temperatures. I will continue taking food and drink out with me and not buy it out. When I want or need something I will first see if I can make it, recycled materials are best, or look in a charity shop, or go to a car boot sale, and look in skips. I don't care if people think I am odd, I don't have to keep up with anyone, I do my own thing.

Right, off out to do three miles. There is a howling wind, should be fun.

Thanks for popping in. Catch up soon. Toodle pip.

I know quite a few people who have no need to watch the pennies. Although no one likes to talk about their financial status it is obvious that they have managed to plan for the future and live in houses a lot nicer, bigger, and newer, than mine. I am assuming that as they drive around in brand new Chelsea Tractors, they must have been in good jobs to be able to splash the cash. I bet you are thinking that there is a touch of jealousy creeping in here, you'd be wrong. Anyone who has the cash to buy what they want can do so. It's when people spend money they haven't got and go into debt for it when the trouble starts. It's a downward spiral from there.

Money saving among the well off is different to the way I do it. I see wealth as a ball and chain around my neck. Ok, imagine you have accumulated £50,000 throughout your working life. What do you do with it? If you have won it or been given it, you wouldn't look on it in the same way as if you had earned it by sweating your nuts off in a job that bored the pants off you. There are thousands of crooks out there who are waiting to get their grubby hands on your nest egg, and I don't just mean scamming individuals as if that isn't bad enough, I mean the legitimate financial institutions who aim to confuse the hell out of you with their predictions, offers, accounts, investments, and personal finance advice. They tell you to put it in this account, invest in that company, buy an ISA or bonds, shift it around several bank accounts. What a load of faff just to hold onto your cash. Phew, I couldn't get my head round that, maths was never my strong point, in fact I am chuffin useless at it. I'm glad I don't have to worry about all that, my personal finances are a lot easier to work out. Juggling money about is one kind of money saving I don't have to bother with.

Extreme couponing has been in the news again. I was asked the question by a journalist, 'Do I collect coupons? My reply, no. Those who have a family to look after and buy a far wider range of products than I do, might save a few bob, but you have to remember, the only reason that companies give out coupons, is to make you buy more. The pictures you see of coupon shoppers pushing trolley loads of stuff back to their cars, then stockpiling it in their garage, makes me wonder if it is more of an obsession rather than an effort to save money. What I want to know is once they have accumulated all this stuff, at what point do they then stop spending altogether, and use up what they have? How do they decide when they have enough? The amount of time and effort they put into searching for the coupons would possibly make it pay less than the minimum wage. Another kind of money saving I don't want to bother with.

Cash back sites seem quite popular, whenever you want to buy something if you go through one of these sites eg, Quidco, they give you money back when you make purchases through their web site. I don't want to sign up to any more sites, and I don't want to do internet shopping because I don't trust the security of it. And what about that Groupon thing, is it still going? Sign up and get all these special offers. If I wanted something I would go out and look for it, I don't need another marketing ploy to get me to part with my cash.

Comparison sites, well they confuse the hell out of me. I want an easy life, if I am happy with what I am paying for goods and services I leave well alone. If I want to change and look for a cheaper deal I will first read Money Saving Expert, then go to the web sites of possible companies, and choose one for myself. Don't tell me to go to a comparison site, I can't be bothered.

So, I have my own methods of managing my money, and although some may say I go to extreme lengths to save a few pennies here and there, I have proved that over a period of time, those pennies mount up and make £'s. My simple way of thinking means that I buy what I need, and if there is anything left over, I can then move on to spend what's left on what I want. I will continue to search out cheap shops to buy food. I will not switch the heating on until I am cold, it's lucky that I spent years working outdoors which got me acclimatized to lower temperatures. I will continue taking food and drink out with me and not buy it out. When I want or need something I will first see if I can make it, recycled materials are best, or look in a charity shop, or go to a car boot sale, and look in skips. I don't care if people think I am odd, I don't have to keep up with anyone, I do my own thing.

Right, off out to do three miles. There is a howling wind, should be fun.

Thanks for popping in. Catch up soon. Toodle pip.

Sunday, December 27, 2015

Going for a long walk, not all in one go.

Hello. I am waiting for a video to upload on yoootooob and it's going to take about three hours. In the meantime I will jot a few words down here. Setting the scene, I am snacking on crackers and soft cheese, Rocky is waiting for his dinner, and Bugsy cat is scratching in the litter box and is about to leave a deposit, charming, and I am sipping the last drop of Christmas wine.

This morning I was invited to a friends house for coffee and Christmas cake. We sat in her very posh living room, it is very beautiful, and had a natter. Rocky came too, and we were joined first by her black puss Bertie, and then her new grey kitten. She is up to nine cats now, not her fault, hubby wanted the kitten, it is lovely though.

This is a picture of my Christmas dinner. As you can see, I don't do traditional food, a non cook salad is fine by me. Tasty blue cheese and plenty of green leaves. Fab.

I had an email saying the applications for Shed of the Year 2016 are now open, so I have been to the web site and put in my details. It accepted the application and then it said we need two or more photo's, so I followed the link and added them. Nothing happened for a minute or two then I got a funny message on the screen so I'm not sure if the photo's have arrived. I will check later. I looked at some of the other photo's and to be honest I don't think my Bespoke Summerhouse has got a chance, some of them are very elaborate. We shall see.A couple of bills have come through the post recently. My electricity bill for the period 26th September to November 27th is £23.40. I don't know why they have sent this as it only covers two months and they had already emailed me to say the next bill would be arriving early January which would have covered three months. I also can't understand why they have given me £12 in credit. I have paid it anyway. There should have been a bill for the gas as well but that hasn't arrived. Confusing. They have sent me a statement saying my electricity costs for this year are £157.93, which is about right, and they estimate that I will be spending £163.86 next year.

The water bill has also arrived from Anglian Water. It covers half a year from 17th June to 11th December. Most of it is standing charges which is a pain, no way to get out of that. The water I have used is £7.30 and the sewerage charge to remove the dirty water costs £4.40. Total bill is £32.55. Oh well, at least it's £3 less than the last bill.

Howz my power walking going? An update. I have been doing a few three mile walks, it takes 50 minutes instead of the 35 for a two mile walk. I'm up to 60 miles and if I do three miles each night to the end of the month it will make it 75 miles on the 31st. I'm chuffed with that. I'm going to have a go at the challenge of walking 1000 miles in one year with Country Walking magazine. My finish date will be 30th November 2016, come back and see if I manage it. I think it's doable. I actually look forward to getting up off my bum and walking around the village at night. 365 days at 3 miles a day is 1095 miles. I wouldn't need to do it every night when I start adding my longer walks into it. It's a bit like saving money, except it's saving miles. The figure of 1000 seems a bit daunting, but if you look at the web site, lots of people are doing it.

Right, off to make my dinner. Surprise surprise, steamed veg tonight, ha ha. 122 minutes left to upload the video. Thanks for popping in. Toodle pip

Wednesday, July 15, 2015

Earn Money Online from Affiliate Marketing | Earn Money from Home by Affiliate Marketing

Hello Friend, Today I m going to show you "How you can Earn money from an Affiliate Marketing or Affiliate Programs" and "Step-by-Step Guide for Affiliate Beginner". Many Big Sites like Amazon, Flipkart, Clickbank, Commission Junction (also known as CJ.com) pay for Selling their Products or Services and their are Millions Sites which Pay Great in Affiliate Programs. The Sites Pay in Amount or Some % of Commission of Product. Mostly Pay some % Commission of the Product purchased by the User whom you brought to the Site. Some Sites pay 500$,1000$ or Even more to their Affiliate Marketers.

Terms you Should know :

What is an Affiliate or Affiliate Marketing or Affiliate Program?

-> According to Wikipedia

How Much can I Earn and How will I get Paid ?

-> You can Earn a Lot in Affiliate Marketing. I have seen many People become Millionaire by doing Affiliate Marketing. Yup, as You need an Idea to sell the Product or Services to the Peoples. You can get Paid by Check,Paypal or Bank Wire Transfer. There May be More Payout Method but Most Commonly Used one is Paypal,Check and Wire Transfer.

Requirement to get Selected in Affiliate Network :

-> Very Less Affiliate Network Requires Website with Good traffic to take Part in their Program. But You still can be Selected in their Network Try a Small Trick. At the Place of Website write the Site www.youtube.com and You are Done. Check out Your Mail box and You will find a Conformation Mail. I have tried this Trick at Many Sites and Got the Success.

Requirement for Affiliate Network:

-> Why to Choose Best Affiliate Program as there are many too because of the Trust and the Loyalty. You don't know who is scam and who is Real so just make a research before choosing the Affiliate Program. You May Loose Your Money and Time. It's also depend upon the Quality of Products the Network going to sell to Customer.

Payment Proofs of Different Affiliate Programs : ( of Amazon Affiliate and Clickbank only)

If you Have Any More Queries then You can Ask in Comment Box. If you Like the Post then please Share it.

Terms you Should know :

- Merchant - The owner of Product or Website whose Product or Site you are Going to send the Customer to make a Purchase.

- Affiliate Marketer or Webmaster- You are the Marketer who Going to Bring the People or Customer to the Merchant Site via a Affliliate Link You will Get from Merchant Site from Which you can Track how Many Customer You have Send and how many had Made a Purchase.

- Customer - The Person or buyer Referred by You to the Merchant Site, Who Buy the Service or Product.

- Affiliate Link - This link is used by You to Send the Customer to Merchant Site and is given by Merchant after Registering to their Affiliate Program.

What is an Affiliate or Affiliate Marketing or Affiliate Program?

-> According to Wikipedia

“Affiliate marketing is a marketing practice in which a business rewards one or more affiliates for each visitor or customer brought about by the affiliate’s marketing efforts”Affiliate Marketer will receive a referral fee or commission from sales when the customer has clicked the affiliate link to get to the merchant's Web site Web site to perform the desired action, usually make a purchase or fill out a contact form.

How Much can I Earn and How will I get Paid ?

-> You can Earn a Lot in Affiliate Marketing. I have seen many People become Millionaire by doing Affiliate Marketing. Yup, as You need an Idea to sell the Product or Services to the Peoples. You can get Paid by Check,Paypal or Bank Wire Transfer. There May be More Payout Method but Most Commonly Used one is Paypal,Check and Wire Transfer.

Requirement to get Selected in Affiliate Network :

-> Very Less Affiliate Network Requires Website with Good traffic to take Part in their Program. But You still can be Selected in their Network Try a Small Trick. At the Place of Website write the Site www.youtube.com and You are Done. Check out Your Mail box and You will find a Conformation Mail. I have tried this Trick at Many Sites and Got the Success.

Requirement for Affiliate Network:

- Website / If You don't have write www.youtube.com

- Ways to Write a Email as You have to Impress Someone with title and First 4 Lines as Nobody Reads if first 4 Lines are Boring. For Email Marketing.

- Follower or Contact list on Social Network.

- Good English for Writing a Blog.

- Just You should know How to Sell the Product. You should have a Good Idea.

-> Why to Choose Best Affiliate Program as there are many too because of the Trust and the Loyalty. You don't know who is scam and who is Real so just make a research before choosing the Affiliate Program. You May Loose Your Money and Time. It's also depend upon the Quality of Products the Network going to sell to Customer.

Top Affiliate Network of CPS(Cost per Sale) of 2015 from BlueBook:

- http://www.linkshare.com

- http://www.cj.com

- https://affiliate-program.amazon.com

- http://www.avangate.com

- https://ebaypartnernetwork.com

- http://www.clickbank.com

- http://shareasale.com

- http://www.flexoffers.com

- http://www.revenuewire.com

- http://www.avantlink.com

- Click here for More

Still Confuse then Just Watch this Video :

Ways to Promote Affiliate Products / Affiliate Marketing Tips:

-> This is the Main thing which is required to sell any Product or Services and to Make Money. Their are Many which have their Own Method of doing Affiliate Marketing. But I have Some Most Commonly Used Method to Promote Products.- By Website - Place the Banner on the Side of your Site.

- By Youtube - Making a Video Related to Product and give the Links in Description.

- By Pintrest - Pin Your Blog Links as Making a Blog is Free by Blogger.com

- By Instagram - Image + Link in Description.

- Facebook Ads - Make a Page and Advertise.

- Google Ads - Advertise your Product link via Google Ads Program as they are the Best and Biggest in Advertising.

- Email Marketing - Send Mails

- Video Marketing - Make Video and Embed them on Post related to it on Forums and Comments on Sites.

- Social Marketing - Twitter Followers,Facebook Followers

- Write Article at Article Directory and add You Link.

- Guest Post at Different Blogs.

- Google for more Ways...

- Below is the Playlist of Affiliate Marketing for Beginners I found.

Payment Proofs of Different Affiliate Programs : ( of Amazon Affiliate and Clickbank only)

If you Have Any More Queries then You can Ask in Comment Box. If you Like the Post then please Share it.

Thursday, June 18, 2015

They're out to get your money

Hello. This is a post about how to save money on parking charges. By sharing my experience with you, it may help you not to make the same mistake as I did. I'll start by saying that I hate paying for parking. There maybe times when it is necessary to cough up, such as the need to be close to where you are visiting, you have a timed appointment, you have elderly or young people with you, or you have heavy bags to carry.

If I am on a day out by myself I will park on the outskirts of a town in a residential street with no restrictions, taking care not block anyone's entrance. Then I will either walk in or get a bus. I hate driving in town centre's and getting lost in a one way system. The few times that I have paid in a car park was when I took Rocky in his buggy, when we had days out at the seaside and I want to be close to the sea front.

When I go to town here I generally drive. I could get the bus, but if I have bags to carry the car is more convenient, and why shouldn't I use it, I paid for it and I enjoy driving it. We have two hours free parking in our town, which is convenient because I can park at the back of the market, get a ticket for my car, and all the shops I need are close by in the High Street. My routine is to go there first, visit the bank, the library, discount stores, and charity shops. When I have finished there, I drive out and go into the Aldi car park, which is close by, and easier to walk from store to car with my food shopping. Then I go home.

On one occasion recently I changed my routine, I went into the Aldi car park first. I wanted a bigger shop, stock up on non perishables, and as I don't make a list I thought I would do that first while it was all fresh in my mind. I am of the opinion that if I forget something then I manage without it, so I don't do lists. I spent £33 that day, usually it's less than a tenner.

With shopping loaded in the car, I decided to walk the short distance to the market and the High Street, and pick up a few other bits and bobs. On my way back to the car, I bumped into someone I hadn't seen for a while so stopped to have a natter. Then I remembered that there was a 2 hour limit for parking at Aldi, and I couldn't remember what time I had pulled into the park. Something told me to keep my store receipt, just in case I had gone over the time.

Shopping centre and store car parks are generally monitored by independent companies, they have a contract with the land owner to police car parking, for which they pay a fee. This helps the store to free up space for their genuine shoppers, and deters people from dumping their car there while they go to work elsewhere. In the case of our local Aldi, that's what used to happen before they brought in a company to monitor movement within the car park. Now every car is photographed on entry and exit.

Two weeks later I got a letter from Parking Eye. I had been clocked going in and out, and had overstayed by 12 minutes. The fine, a hefty £70, reduced to £40 if paid within a week. Now this seems grossly unfair being as I am a customer of Aldi. OK, I shouldn't have gone to town and left my car there, because the park is only supposed to be used for the actual time you are in the store. There are signs, but they are high up on posts so you have to squint to read them.

First thing the following morning I got myself down to Aldi, and found the manager doing his stock check in the first aisle. I explained what had happened, showed him the letter and till receipt, and admitted my mistake. He took the letter from me and told me not to worry, he would get it cancelled. He said I will get some more letters because it takes time for it to go through the system. I thought, what a reasonable chap he is, in fact I was impressed by his excellent customer relations.

I will at this point just mention that the letters appear very threatening when they arrive. The £70 charge is in bold letters, and they demand that you pay. People often think this is a car parking fine, it isn't, the company cannot fine you, it is an invoice. They threaten to take you to court if you ignore it. All very intimidating. A lot of people cave in at the first hurdle and pay up. That's what they want to happen.

I got three letters in total, then they stopped. I didn't open the second and third letters, I refuse to be bullied. At the end of the day, the land belongs to Aldi, the manager can liaise with head office and override the parking company if he or she so wishes. Luckily the manager here is a decent sort. My friend got caught at the same car park, he felt intimidated by the letter and paid. Afterwards he went to Aldi and complained. Head office sent him a voucher for the full amount to be spent in the store.

If you have been stung with these sort of parking charges, go to Money Saving Expert and read up about it. These are not real parking tickets. Read this thread first. It will explain the procedure for challenging the parking company. Then read this thread how people are fighting their unfair charges.

Watchdog on BBC television have also done a report on these car parking companies. They sent an undercover reporter to work in an office, with a hidden camera. What they found was a room full of people all intent on squeezing as much money out of the public as possible, by whatever means.

A lot of people are fighting these charges on the grounds that the signs are not clear, that they didn't see them because they appear to be hidden. Others are challenging the legality of the actual wording in the letters, and the biggest bug bear is that the charges are disproportionate to the perceived crime. If your appeal is rejected, you can then go to POPLA, an ombudsman. A high percentage of people are getting their charges cancelled at some stage, it all depends on how long you are prepared to hang on in there.

Here are a couple of vids from yooootooob to watch. There are many more.

Anyway, what have I learnt from this? Always note what time I entered a car park. I may have to write it down because I get distracted and forget easily. Always read the signs. Always remove my car before the time expires. If I do that I shouldn't get any more demands for money.

Thanks for reading. Toodle pip

If I am on a day out by myself I will park on the outskirts of a town in a residential street with no restrictions, taking care not block anyone's entrance. Then I will either walk in or get a bus. I hate driving in town centre's and getting lost in a one way system. The few times that I have paid in a car park was when I took Rocky in his buggy, when we had days out at the seaside and I want to be close to the sea front.

When I go to town here I generally drive. I could get the bus, but if I have bags to carry the car is more convenient, and why shouldn't I use it, I paid for it and I enjoy driving it. We have two hours free parking in our town, which is convenient because I can park at the back of the market, get a ticket for my car, and all the shops I need are close by in the High Street. My routine is to go there first, visit the bank, the library, discount stores, and charity shops. When I have finished there, I drive out and go into the Aldi car park, which is close by, and easier to walk from store to car with my food shopping. Then I go home.

On one occasion recently I changed my routine, I went into the Aldi car park first. I wanted a bigger shop, stock up on non perishables, and as I don't make a list I thought I would do that first while it was all fresh in my mind. I am of the opinion that if I forget something then I manage without it, so I don't do lists. I spent £33 that day, usually it's less than a tenner.

With shopping loaded in the car, I decided to walk the short distance to the market and the High Street, and pick up a few other bits and bobs. On my way back to the car, I bumped into someone I hadn't seen for a while so stopped to have a natter. Then I remembered that there was a 2 hour limit for parking at Aldi, and I couldn't remember what time I had pulled into the park. Something told me to keep my store receipt, just in case I had gone over the time.

Shopping centre and store car parks are generally monitored by independent companies, they have a contract with the land owner to police car parking, for which they pay a fee. This helps the store to free up space for their genuine shoppers, and deters people from dumping their car there while they go to work elsewhere. In the case of our local Aldi, that's what used to happen before they brought in a company to monitor movement within the car park. Now every car is photographed on entry and exit.

Two weeks later I got a letter from Parking Eye. I had been clocked going in and out, and had overstayed by 12 minutes. The fine, a hefty £70, reduced to £40 if paid within a week. Now this seems grossly unfair being as I am a customer of Aldi. OK, I shouldn't have gone to town and left my car there, because the park is only supposed to be used for the actual time you are in the store. There are signs, but they are high up on posts so you have to squint to read them.

First thing the following morning I got myself down to Aldi, and found the manager doing his stock check in the first aisle. I explained what had happened, showed him the letter and till receipt, and admitted my mistake. He took the letter from me and told me not to worry, he would get it cancelled. He said I will get some more letters because it takes time for it to go through the system. I thought, what a reasonable chap he is, in fact I was impressed by his excellent customer relations.

I will at this point just mention that the letters appear very threatening when they arrive. The £70 charge is in bold letters, and they demand that you pay. People often think this is a car parking fine, it isn't, the company cannot fine you, it is an invoice. They threaten to take you to court if you ignore it. All very intimidating. A lot of people cave in at the first hurdle and pay up. That's what they want to happen.

I got three letters in total, then they stopped. I didn't open the second and third letters, I refuse to be bullied. At the end of the day, the land belongs to Aldi, the manager can liaise with head office and override the parking company if he or she so wishes. Luckily the manager here is a decent sort. My friend got caught at the same car park, he felt intimidated by the letter and paid. Afterwards he went to Aldi and complained. Head office sent him a voucher for the full amount to be spent in the store.

If you have been stung with these sort of parking charges, go to Money Saving Expert and read up about it. These are not real parking tickets. Read this thread first. It will explain the procedure for challenging the parking company. Then read this thread how people are fighting their unfair charges.

Watchdog on BBC television have also done a report on these car parking companies. They sent an undercover reporter to work in an office, with a hidden camera. What they found was a room full of people all intent on squeezing as much money out of the public as possible, by whatever means.

A lot of people are fighting these charges on the grounds that the signs are not clear, that they didn't see them because they appear to be hidden. Others are challenging the legality of the actual wording in the letters, and the biggest bug bear is that the charges are disproportionate to the perceived crime. If your appeal is rejected, you can then go to POPLA, an ombudsman. A high percentage of people are getting their charges cancelled at some stage, it all depends on how long you are prepared to hang on in there.

Here are a couple of vids from yooootooob to watch. There are many more.

Anyway, what have I learnt from this? Always note what time I entered a car park. I may have to write it down because I get distracted and forget easily. Always read the signs. Always remove my car before the time expires. If I do that I shouldn't get any more demands for money.

Thanks for reading. Toodle pip

Saturday, May 23, 2015

When does a simple routine become more complicated to the point of being obsessive?

Hi peeps.

From time to time I get emails asking for tips and advice. I try my best to come up with a constructive reply, but be aware that I don't know everything. I am not Superwoman, I just do my best with the life I have been given. An email dropped in my box this week.

Hi Ilona,

I hope you don't mind me asking for some advice.

I seem to complicate things with a lot of paperwork re. our finances and bank accounts, vouchers, shopping rewards cards etc., do you keep reward cards? We use credit cards for rewards and pay off every month so we don't pay interest. Its not budgeting I need help with, its just a simpler way of doing things. As we get older I'm so overwhelmed now with things. I use a budget software and categorize everything which I want to stop doing! Can you give me any tips please.

Thank you.

Hi Anon. I do have your name but I will not reveal, thanks for contacting me. At first glance you seem to have a lot going on regarding your finances. It will be difficult to make comparisons between how you manage your money and how I manage mine, because of the differences in incomings and outgoings. Maybe it would be a good idea to highlight these differences. I have a state pension and a small top up pension, no savings except for a small emergency fund, that's it. You may have more incomings from different places, stocks, shares, investments, savings. My whole lifestyle is very simple, you may have more going on in yours. Your spending will be different to mine, your priorities will be different. I have no commitments other than to provide for my pets, you may have other family members involved which can complicate things.

You say 'bank accounts plural, I'm wondering how many you do have, and what you use them for? I have one account which everything goes through. I get a statement in the post which I can check. I have minimum direct debits, I never get more than one page because there is not much activity going on there. I withdraw cash from the machine inside the bank as and when I need it, £50 or £100, more if I am going on holiday. I have no problem with cash in my purse, because I have a strong discipline that I don't make impulse purchases. It will be two, three, or four weeks before I need to get some more out.

You ask about shopping rewards cards, I assume you mean store cards. I don't have any, why would I need them. Most of the purchases I make are in shops which don't have cards. You have to remember that store/loyalty cards are only dished out to entice the customer to spend more. I know how much I want to spend, and where I want to spend it, a card is not going to make me spend more. Dump those which you haven't used for a while and never go in their shops again, it makes life more simpler.

I have one credit card, that's all I need. Years ago I used to juggle a few cards with 0% interest, purely to fund large purchases. It worked for me at the time, but as the statements were cleared I cut up the cards and cancelled the contracts. My one credit card earns me points, not many because my spending is controlled. I use it for convenience, mainly for petrol and food shopping, and of course it is cleared every month. I'm wondering how many credit cards you have? And why do you need more than one? How many statements do you get every month? If you are juggling several, can you use just one card, keeping it all in one place? On my one monthly statement I usually have only three or four lines on it at most.

Vouchers. I assume you mean money off vouchers. I know there has been a lot in the press, and some bloggers are really keen on couponing, to the extreme in some cases. I use very few of the vouchers I receive. You have to remember that vouchers are given to encourage you to spend more. If I forget to use a voucher before the date expires, I say, so what, I didn't need it anyway.

A lot of people find budget software a useful tool for keeping track of things. I haven't tried any, I don't need to. It would be like adding an extra layer to my simple way of checking my finances, and would entail sitting in front of the computer longer than I already do. No thanks, I am not a number cruncher. All I need to know is that my pension is going into the bank every week, the few cheques I write are cashed, the withdrawals I make from the machine are entered on the statement, and the two monthly direct debits have gone out.

I used to keep a spending diary when things were really tight, when my income was so low I had to account for every penny to make sure there was enough to pay the mortgage, utilities and council tax. I was sailing close to the wind at times, but my bank balance never dropped below the bottom line. The spending diary I had was a note book, took a couple of minutes to enter figures when I came back from shopping with the receipts.

I have never needed to use a budget software to keep track. I see that as over complicating matters. I keep pieces of paper in different folders in date order. Once checked they are put away and forgot about. I only get them out if I need to go back to something a few months or even a year before, if some query arises and I need to verify something I have the statements.

So, Anon, are there two people in your house? You say, 'as we get older I'm so overwhelmed with things'. Does this mean that all the finances are left up to you? Is that a job you willingly do, or is it that your partner does not want to be involved? Are you perhaps becoming a little bit obsessed with keeping things tidy and in little boxes? Everything in it's place? I'm wondering if this is a reflection of how you tackle your housework, your appointments diary, and your social life? Are you a person who needs to scrutinize every little detail about your life? Of course I am only surmising I only have your short email to go on. But I'm wondering if your complicated paperwork system is part of a bigger picture.

You say, 'categorizing everything which I want to stop doing'. Not sure what you mean by that. I think you have missed a comma out there. You maybe want to stop categorizing. Ok, try this.

You need to declutter your paper/software systems. Give them a good clear out, only hang on to the information you need. Again it's down to 'needs' and 'wants'. Once you have a good understanding in your head of where your money is coming from and how it is spent, and that your budgeting is under control, you can begin to relax a little. I don't need to account for every penny now, my diary is redundant, because I trust myself not to go bananas and spend willynilly.

If you are confident with your budgeting, try letting go of the reigns a little bit. Get rid of cards which you are not using, cut it right down to one or two. The points and rewards you accrue though using them are so piddlingly small it's not worth the hassle of keeping them.

Vouchers. Sort them out as soon as they come into your hands. Do not hang on to any that you definitely won't use, or those that you might use. Chances are that you will forget and they will be out of date. Bin them straight away, banish them from your house. You have more important things to think about rather than rushing off to Tesco to get 10p off a pack of frozen peas. I get the £3 and £4 off a £30 shop at Tesco. I only ever use the £4 off one, the rest get binned.

Close down your budget software, delete it. I know everyone is trying to get their customers on paperless billing, but I love it, and will not change. I have box files, the bills are checked and bills filed. Put away in a box where I don't have to look at them. If you have to stick with your computerized system, and you are confident that you are not overspending, only check things to make sure your cards have not been cloned or your account has not been hacked into.

Personally I am very careful where I give my credit card details. I don't have any financial information on my computer. No internet shopping, no paying bills on line, no banking online. I take great care where I withdraw cash, only at a machine inside a bank, never outside.

Phew, I think I've covered most points. If there is anything more to ask dear Anon, please email me again. It's sunny outside, it's a Saturday morning, and I'm going to get off my backside and get out there.

I hope you have a lovely weekend, whatever you are doing.

Tattybyes and Toodle pip.

PS. Please be aware that if you are reading seconds after I have published, what you see might not be the finished article. I always edit after I publish. Thanks for your patience.

PPS. I've just looked at the title of this post again. I am obsessively simple, ha ha.

From time to time I get emails asking for tips and advice. I try my best to come up with a constructive reply, but be aware that I don't know everything. I am not Superwoman, I just do my best with the life I have been given. An email dropped in my box this week.

Hi Ilona,

I hope you don't mind me asking for some advice.

I seem to complicate things with a lot of paperwork re. our finances and bank accounts, vouchers, shopping rewards cards etc., do you keep reward cards? We use credit cards for rewards and pay off every month so we don't pay interest. Its not budgeting I need help with, its just a simpler way of doing things. As we get older I'm so overwhelmed now with things. I use a budget software and categorize everything which I want to stop doing! Can you give me any tips please.

Thank you.

Hi Anon. I do have your name but I will not reveal, thanks for contacting me. At first glance you seem to have a lot going on regarding your finances. It will be difficult to make comparisons between how you manage your money and how I manage mine, because of the differences in incomings and outgoings. Maybe it would be a good idea to highlight these differences. I have a state pension and a small top up pension, no savings except for a small emergency fund, that's it. You may have more incomings from different places, stocks, shares, investments, savings. My whole lifestyle is very simple, you may have more going on in yours. Your spending will be different to mine, your priorities will be different. I have no commitments other than to provide for my pets, you may have other family members involved which can complicate things.

You say 'bank accounts plural, I'm wondering how many you do have, and what you use them for? I have one account which everything goes through. I get a statement in the post which I can check. I have minimum direct debits, I never get more than one page because there is not much activity going on there. I withdraw cash from the machine inside the bank as and when I need it, £50 or £100, more if I am going on holiday. I have no problem with cash in my purse, because I have a strong discipline that I don't make impulse purchases. It will be two, three, or four weeks before I need to get some more out.

You ask about shopping rewards cards, I assume you mean store cards. I don't have any, why would I need them. Most of the purchases I make are in shops which don't have cards. You have to remember that store/loyalty cards are only dished out to entice the customer to spend more. I know how much I want to spend, and where I want to spend it, a card is not going to make me spend more. Dump those which you haven't used for a while and never go in their shops again, it makes life more simpler.

I have one credit card, that's all I need. Years ago I used to juggle a few cards with 0% interest, purely to fund large purchases. It worked for me at the time, but as the statements were cleared I cut up the cards and cancelled the contracts. My one credit card earns me points, not many because my spending is controlled. I use it for convenience, mainly for petrol and food shopping, and of course it is cleared every month. I'm wondering how many credit cards you have? And why do you need more than one? How many statements do you get every month? If you are juggling several, can you use just one card, keeping it all in one place? On my one monthly statement I usually have only three or four lines on it at most.

Vouchers. I assume you mean money off vouchers. I know there has been a lot in the press, and some bloggers are really keen on couponing, to the extreme in some cases. I use very few of the vouchers I receive. You have to remember that vouchers are given to encourage you to spend more. If I forget to use a voucher before the date expires, I say, so what, I didn't need it anyway.

A lot of people find budget software a useful tool for keeping track of things. I haven't tried any, I don't need to. It would be like adding an extra layer to my simple way of checking my finances, and would entail sitting in front of the computer longer than I already do. No thanks, I am not a number cruncher. All I need to know is that my pension is going into the bank every week, the few cheques I write are cashed, the withdrawals I make from the machine are entered on the statement, and the two monthly direct debits have gone out.

I used to keep a spending diary when things were really tight, when my income was so low I had to account for every penny to make sure there was enough to pay the mortgage, utilities and council tax. I was sailing close to the wind at times, but my bank balance never dropped below the bottom line. The spending diary I had was a note book, took a couple of minutes to enter figures when I came back from shopping with the receipts.

I have never needed to use a budget software to keep track. I see that as over complicating matters. I keep pieces of paper in different folders in date order. Once checked they are put away and forgot about. I only get them out if I need to go back to something a few months or even a year before, if some query arises and I need to verify something I have the statements.

So, Anon, are there two people in your house? You say, 'as we get older I'm so overwhelmed with things'. Does this mean that all the finances are left up to you? Is that a job you willingly do, or is it that your partner does not want to be involved? Are you perhaps becoming a little bit obsessed with keeping things tidy and in little boxes? Everything in it's place? I'm wondering if this is a reflection of how you tackle your housework, your appointments diary, and your social life? Are you a person who needs to scrutinize every little detail about your life? Of course I am only surmising I only have your short email to go on. But I'm wondering if your complicated paperwork system is part of a bigger picture.

You say, 'categorizing everything which I want to stop doing'. Not sure what you mean by that. I think you have missed a comma out there. You maybe want to stop categorizing. Ok, try this.

You need to declutter your paper/software systems. Give them a good clear out, only hang on to the information you need. Again it's down to 'needs' and 'wants'. Once you have a good understanding in your head of where your money is coming from and how it is spent, and that your budgeting is under control, you can begin to relax a little. I don't need to account for every penny now, my diary is redundant, because I trust myself not to go bananas and spend willynilly.

If you are confident with your budgeting, try letting go of the reigns a little bit. Get rid of cards which you are not using, cut it right down to one or two. The points and rewards you accrue though using them are so piddlingly small it's not worth the hassle of keeping them.

Vouchers. Sort them out as soon as they come into your hands. Do not hang on to any that you definitely won't use, or those that you might use. Chances are that you will forget and they will be out of date. Bin them straight away, banish them from your house. You have more important things to think about rather than rushing off to Tesco to get 10p off a pack of frozen peas. I get the £3 and £4 off a £30 shop at Tesco. I only ever use the £4 off one, the rest get binned.

Close down your budget software, delete it. I know everyone is trying to get their customers on paperless billing, but I love it, and will not change. I have box files, the bills are checked and bills filed. Put away in a box where I don't have to look at them. If you have to stick with your computerized system, and you are confident that you are not overspending, only check things to make sure your cards have not been cloned or your account has not been hacked into.

Personally I am very careful where I give my credit card details. I don't have any financial information on my computer. No internet shopping, no paying bills on line, no banking online. I take great care where I withdraw cash, only at a machine inside a bank, never outside.

Phew, I think I've covered most points. If there is anything more to ask dear Anon, please email me again. It's sunny outside, it's a Saturday morning, and I'm going to get off my backside and get out there.

I hope you have a lovely weekend, whatever you are doing.

Tattybyes and Toodle pip.

PS. Please be aware that if you are reading seconds after I have published, what you see might not be the finished article. I always edit after I publish. Thanks for your patience.

PPS. I've just looked at the title of this post again. I am obsessively simple, ha ha.

Friday, April 17, 2015

Earn Money Online In India Without Investment For Students

Recently I have spoken in my post about How to Make Money with Bidvertiser (Extra Way for Earning) and I will try to make money in future more. What works for me in one niche, may not be working for you for another.

I received many emails every week from my readers asking me how to make money from my website? What should I do?

My answer is same to you all, it depends you how big your site is how it is new website, what niche you are in, what is your goal, aim, etc. My today’s post will answer your questions about what monetization technique is best for your website.

Passes of years I have tried dozens of new tricks for earning money, if not hundreds of ideas and ways to make money from my websites. Some worked me and some failed, it is very important that if you try something and it doesn’t work, don’t just give up. The main reason I have seen many peoples fail with their business online, as they give up too soon without spending more time for their business.

For earning money it requires some time. Take a look at screenshot below from my inbox of all the emails from PayPal, notifying me that I have earned money:

Ways to Monetize Your Websites

Sell Advertising Space

The most popular way of making money from a website is by placing ads on your own website. We all know what it is, but it can make you money in different ways, such as Paid Per Click, Paid Per Time Frame or Paid Per 1000 Views.

The most common way of advertising is Google Adsense which is PPC program; however a many peoples know what is Adsense this industry so perhaps in those markets the other too may be more profitable.