Hello. We wake up this morning to more doom and gloom in the press, inflation is rising and we are all going to have to pay more for the things we need to give us the life that we aspire to. But wait a minute, not everyone will suffer, those of us who understand the difference between a need and a want, will still be able to adjust our finances to get the best possible deals. We know it's all down to juggling, and from the comments I get from my readers, most of us have got it about right, so this post is not aimed at you.

What do you do when you can't afford to buy new clothes from a High Street shop? Answer, you go to a charity shop, a car boot sale, a rummage sale, a garage sale, accept hand me downs, swap clothes with friends, look on ebay and the free sites.

What do you do when you can't afford expensive brand name foods? Answer, you try the shop's own brand, you buy the Value and Basics labels, you shop around in different places, you get to know the prices of everything you buy on a regular basis, you look for reductions, offers, and out of date reductions.

What do you do when you can't afford your utilities? Answer, you check how many kw's you are using per annum and go on the comparison sites and look for a better deal. You contact your present provider and ask them for a cheaper tariff. You use less gas, electricity, and water by not switching things on until it is absolutely necessary. Flick a switch, turn a tap on, it will cost you.

Petrol is going up, how can you spend less? By driving correctly, not rushing about, no harsh braking or fast acceleration. Plan your driving by what you can see ahead of you. There's been many times when I have seen a bend or a junction up ahead and have slowed down by just taking my foot off the gas, when the car in front has approached it at speed, then slammed their brakes on. Remove all the clutter from your car, more weight uses more petrol.

Shop around for literally everything. Think about what you need, then look in different places to get the best price. Give yourself time before you sign a cheque, open your purse, or put your card in a machine. Be very aware of what you are spending your money on. Absolutely no impulse spending, go home and think about it.

Put a little money aside every week or month, into a savings account. Doesn't have to be much. One day you will need a new washer or fridge. Your car will eventually conk out, if you have planned and saved it won't be so painful when you come to change it. I've had my car almost two years, I started saving as soon as I got it, there will be enough in the pot when I come to change it.

If you enjoy a few extras at Christmas, start saving on January the 1st. If you like a summer holiday, have a pot for that. Write a plan on a piece of paper, you don't need fancy electronic gadgets to keep track of your money, a notebook does the same job. The miles I do for my walking challenge are recorded on a calendar, I don't need a gadget for that. Pen and paper is all you need. Keep a spending diary, record every penny you spend, look back on it often.

All this is common sense, and a lot of you who are a similar age to myself will know what I am talking about. It's the younger people who are struggling, those that don't get the benefit of savvy parents to teach them, which I feel for.

Right, so what do you do when you are really struggling to make ends meet? All of the above, but what you don't do is BORROW. Loan companies know people will be struggling once inflation rises and gets a grip, they will be increasing their advertising to reel in all those who don't know which way to turn next. The sharks are waiting for the kill.

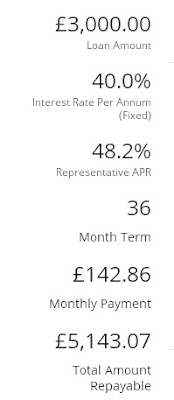

Do not fall for it. MSE is full of posts from people who are in such a mess with their finances. They know they have been living beyond their means, and know they will never have a life if they don't try and do something about it. Borrowing is too easy. Spending someone else's money is too easy. If people can't afford to pay for something, how are they going to afford the repayments? Look at the figures below, found on a random web site. Borrow £3,000 to buy a car. It takes three years to pay it back. You will have paid £5,143 to this company if you borrow from them, and you will be left with a scrap heap of a car worth nothing.

What did I do when I started driving? I bought a battered old Bedford van for cash saved. Changed it for another slightly better van, then worked my way up with more old vehicles. I went to car maintenance classes at the college to learn how to do the basics. And at long last after years of driving around in a vehicle which I could never be sure of it getting me there, I now have a decent car.

So, don't despair if the cost of living is going up, try and keep one step ahead. Appreciate what you already have. Find ways of staying in control, make it a challenge, don't let the buggers beat you. There is Life after Money.

Thanks for popping in, we'll catch up soon.

Toodle pip

No comments:

Post a Comment